Loss Aversion has a Hidden Cost

“In human decision-making, losses loom larger than gains.”

– Kahneman & Tversky (Prospect Theory)

In economics and decision theory, loss aversion refers to people’s tendency to strongly prefer avoiding losses to acquiring gains. Some studies suggest that losses are twice as powerful, psychologically, as gains. (Wikipedia).

Simply put, losses have the same psychological effect as pain and have twice the impact of gain (pleasure). Our brains are wired to avoid pain. This affects the decision making process without our being conscious of it. The ramifications can be devastating. It leads to risky behavior.

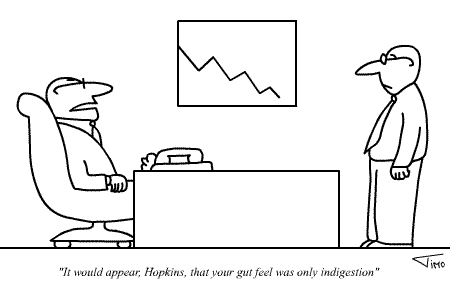

The loss averse person attempts to avoid loss at all costs. But what are those costs?

Jonah Lehrer points out: “Loss aversion (also) explains one of the most common investing mistakes: investors evaluating their stock portfolio are most likely to sell stocks that have increased in value. Unfortunately, this means that they end up holding on to their depreciating stocks. Over the long term, this strategy is exceedingly foolish, since it ultimately leads to a portfolio composed entirely of shares that are losing money… Why do investors do this? Because they are afraid to take a loss⎯it feels bad⎯and selling shares that have decreased in value makes the loss tangible. We try to postpone the pain for as long as possible. The end result is more losses.”

This translates in to how we frame and rationalize investment and savings instruments.

A loss averse person may choose a bank CD over investing in the capital markets because they don’t want to lose money in the markets. However, in the current low interest rate environment coupled with rising inflation, they are actually losing purchasing power. So, the CD is not as ‘safe’ from loss as they thought. (I won’t get into the tax implications).

“Loss aversion would come into play when considering the purchase of certain types of annuities such as a single premium immediate annuity that involve a single premium payment rather than a series of premium payments over time. In other words, a situation where a person might—to use a highly simplified example—provide $500,000 to an insurance company in exchange for a $25,000 per year annuity payment that lasts for the rest of his or her life. The person might frame the $500,000 annuity premium as a potential investment loss rather than seeing it for what it is—a conversion of assets into a guaranteed stream of payments that supports consumption during retirement.” (Tom Cochran)

In conclusion, loss aversion can lead to actual loss. We must be conscious of our decisions and their ramifications. Most of us can agree that taking unnecessary risk is NOT a good choice. But, driving our car off of the road to avoid a pot-hole because it may damage our car is a bit risky, don’t you think?

Credits: Article references credited to: Jonah Lerher-The Frontal Cortex-Loss Aversion (Feb. 10,2010) and Tom Cochran-Harvard Professor Roland Fryer – The Annuity Puzzle and Why People are More Comfortable Flying if They Can See the Cockpit (March 11, 2009)

…

This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. Please consult with a professional specializing in these areas regarding the applicability of this information to your situation.