by Lance Cashion | Jan 15, 2014 | Culture, Education, Financial Blind Spots, Personal Growth, Productivity, Uncategorized, Wisdom

Why we can’t make up our minds?

Have you ever found yourself ‘channel-surfing’ for something to watch on TV? You’ve had a long day and you sit down to watch a program but don’t know what you want to watch. So, you begin the search through the hundreds of options. You are bombarded with an array of choices. What should have been a two minute decision has morphed into a full-on half-hour mind-bender. Finally, you give up and go to bed frustrated.

The ‘channel-surfing’ example is a very low-level decision. However, it provides insight into how our minds analyze information in order to make a decision. When we’re presented with more than three choices or options, we sometimes experience decision paralysis (analysis paralysis). It’s death by over-thinking. Remember this next time you go to the store for headache medicine or a packet of chewing gum. Our modern culture is overrun with options to our own detriment. (more…)

by Lance Cashion | May 7, 2013 | Education, Family, Financial Blind Spots, Lance's Philosophy, Stewardship, Uncategorized, Wisdom

Marines are known for being tough and practical. One does not become Lieutenant Colonel and pilot in the Marines without knowing a thing or two.

Last year I met such a Marine at a charity event. During our short conversation, he inquired about my work. I told him about my passion for impacting lives in various ways through my work as a Financial Advisor. Little did I know that I was about to be equipped with a valuable tool. When I have the opportunity to learn a practical life skill from someone with a great deal of experience, I jump at it. Then, I like to pass along the information.

A good teacher must be teachable. I emailed him and below is the content of his reply.

(My additions/edited portions of What If File Essentials are in bold italics)

The “What If” File by LtCol. Mitch Bell:

This isn’t just for the Marine or Soldier going over to the War, it’s for everyone, guy or gal. We all believe that we’ll live forever! I mean it. When you are young, you are bullet proof and as you get older, you just never expect that you will die. Well, I am speaking as a guy who lost his sister while in college, his college roommate fifteen months later, and about a dozen guys in plane crashes over my adult life. With this in mind, I came up with a “What if” file.

The “What if” file is a complete folder for my next of kin on what to do if I get whacked by a drunk driver in the morning on the way to work. This is to ensure that my wife and parents would not have to search through old papers, files, boxes in the closet etc to track down my investments, mortgages, car info, work info, passwords etc. Now mind you, the “what if” file is a VERY important document, and should be placed in your fire proof home safety deposit box or gun safe, or with your folks and/or your wife in a safe, secure place. It would be bad news falling into the wrong hands with all that info in one place.

Here is what I did when I married my beautiful wife. I wrote a letter to her, very personal and with the intent that it would my last words to her. I also told her what needed to be done and in what order.

‘What If’ File Essentials:

-

Copies of all bank statements

- Copies of your investment statements (IRA, 401k, retirement accounts, etc)

- Account numbers (these are required to cancel credit cards and find out what bills have to be paid)

-

Copies of all life insurance policies (beneficiary information)

- All online passwords (Banks and Financial Institutions)

-

POC’s (point of contact) include correct phone numbers

-

POC within your state to retrieve death certificate (In order to claim insurance death benefit and notify Social Security)

- POC (supervisor/partners) at work to notify so they don’t call due to your absence.

- Passwords for email accounts & social media (Facebook), so that your family can send out an message via your address notifying all your contacts about your death or serious injury. Otherwise your family will have to provide your death certificate to AOL, Facebook, Gmail, Hotmail, etc to access your accounts.

- An envelope with $1,000 in cash to cover immediate and unforeseen needs

- Instructions for burial

-

Copy of your current (valid) Will (Trust Documents)

-

Copies of your Living Will/Advance Directive/and Power of Attorney (if needed)

- List of items of value in your estate (you don’t want them sold for pennies on a dollar at an estate sale)

- List 3 primary contacts (friends and/or family) who can notify others of the situation at the behest of your spouse.

This is just a start, a basic road map for you. There are many more things you can add to it. I’m death on Marines who don’t have this set up, and so is my Dad who has an extensive “what if” file. I’ve seen too many cases where a Marine has died, and he didn’t switch over his life insurance from his EX-wife who he hates, and she now has won the lotto with a tax-free check while his present wife gets nothing. That is pure laziness and I despise it.

Just remember that dying is the easy part of life; it’s the loved ones you leave behind that suffer. If you have your life tied together in a “What If” folder, when that unexpected time comes, it will make life so much easier for the ones left behind. If you care about your spouse/kids and folks, take the time today to start putting one of these together, and store it in your home fireproof safety deposit box(but watch out if you use a banks they will close those up tight till the probate of the will if you don’t clean it out fast).

I hope this post helps. Please copy it, and send it to your friends and family. I would be willing to bet you a beer that if polled, only about one out of ten will have anything remotely set up like a “What If” file.

-Semper Fi, Mitch

Do you have a ‘What if’ file? Would you add anything to this list?

Special Thanks to LtCol Mitch Bell for permission to share this material on my blog.

by Lance Cashion | Sep 20, 2011 | Annuities, Education, Financial Blind Spots, Retirement, Uncategorized

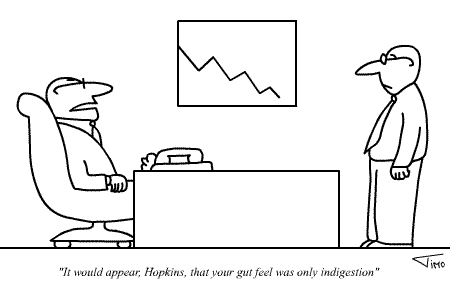

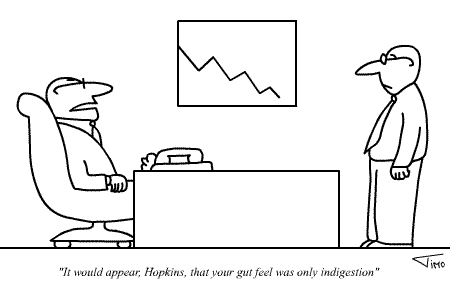

Loss Aversion has a Hidden Cost

“In human decision-making, losses loom larger than gains.”

– Kahneman & Tversky (Prospect Theory)

In economics and decision theory, loss aversion refers to people’s tendency to strongly prefer avoiding losses to acquiring gains. Some studies suggest that losses are twice as powerful, psychologically, as gains. (Wikipedia).

Simply put, losses have the same psychological effect as pain and have twice the impact of gain (pleasure). Our brains are wired to avoid pain. This affects the decision making process without our being conscious of it. The ramifications can be devastating. It leads to risky behavior.

The loss averse person attempts to avoid loss at all costs. But what are those costs? (more…)